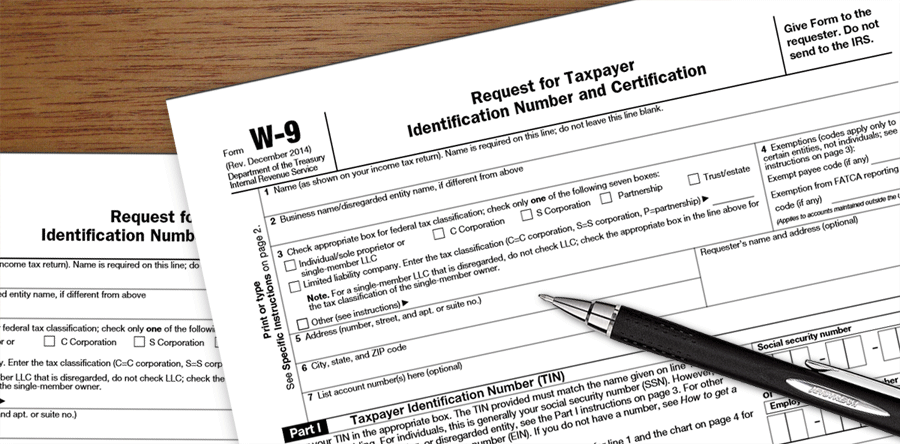

If you’re a serial online survey taker and rack up a lot of earnings, you may be asked by the survey companies you’re a member of to complete a W9 Form. Here we’ll explore what W9s are, how they’re used and why you should fill them out.

What W-9’s are used for

When a market research company pays a survey taker $600 or more in the course of a tax year, they are required to report these payments to the IRS. The survey company will request that survey takers who have earned this amount to fill out a W-9 form. The survey company will then use the information on W-9s to fill out a form called a 1099-MISC, which they will then submit to the IRS.

What W-9 Forms ask

Form W-9 is short form that is to completed by US taxpayers. It’s pretty short and mainly asks for a taxpayer’s identifiable information: name, address, business entity (if applicable), and SSN are the main boxes to fill in. It also asks whether the person filling out the form is exempt from backup withholding (most people are exempt from this).

Since the form requires listing a tax ID or Social Security number, survey companies will typically request that the completed forms be mailed to their head office (versus emailed), as they know that the information provided on these forms is sensitive. This is the ONLY time it is acceptable for survey takers to provide their SSNs to a survey company.

Where to report W-9 income

Report your online surveys income under “Other income” on your tax return. You can lump all of your earnings together and report it on the “other income” line (currently, line 21) on your tax returns. This line encompasses a broad spectrum of sources of income such as lottery winnings, scholarships, rebates, etc. Online surveys income falls under the subcategories, Non-employee Compensation and Rewards and can be included here. However, if you filled out a W9, it may be best to use Schedule C.

Do non-USA residents fill out W-9s?

If you’re located outside the US, but earn $600 or more in any given calendar year with a market research company located in the USA, you may be asked to complete a W8-BEN. This is essentially the W-9 equivalent for non-USA residents. The form is pretty simple and is called, “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals).” It essentially verifies that you are a non-USA resident, and are the beneficial owner of the income. Once completed, the form should be submitted to the payor (in this case, the market research company) and not to the IRS.

Foreign persons are subject to the U.S. income tax rate of 30% however many, if not most developed nations have a tax treaty with the USA so that residents of these countries will not have any of their earnings withheld. However, again, you must complete a W8-BEN in order to verify your citizenship of one of these nations in order to have nothing withheld and to continue receiving your earnings without issue.

I don’t have $600 in earnings, yet I’m still being asked to complete a W-9!

When your survey earnings start to encroach upon hitting the $600 mark, a survey company may ask you to complete a W-9 anyway. When you’ve earned around $500, the survey company wants to ensure that things are seamless for when you actually hit the magic $600 mark; if the paperwork is done in advance, they can continue to send you surveys and you can continue to earn income, without any interruptions.

How much will I pay in taxes on my surveys income?

As we outline in our blog post, Paying Taxes on Online Survey Income in the USA, this depends on your tax bracket. If your overall income is low, you won’t need to pay anything on your survey earnings, though you still need to file a return with the IRS. Filing a return is required by all US citizens and is law.

Remember that regardless of whether or not you’re asked to complete a W9, you should be claiming all survey earnings (including the value of any gift cards you receive) on your income taxes. The IRS may not be directly informed when you earn less than $600 from a survey company, but that doesn’t mean you shouldn’t report it.

Different panels, one W-9

Sometimes a survey company operates multiple survey panels, and in these cases, you will be considered a contractor for ALL of their survey panels. That means that if you earn a combined total of $600 spanning all panels that the company operates, you will be asked to complete a W9. Many survey takers are surprised by this when for example, they earn $100 in a calendar year with one survey panel, and $500 in the same year with another panel and are then requested to fill out a W9. If the panels have the same owner, your earnings across all their survey panels will be combined to form one total. If this total is near $600, you will have to fill out the form.

What I refuse to fill out a W-9?

If you’re asked to complete a W-9, but refuse to do so, you may be penalized $50 by the IRS for every instance. As well, the market research company may withhold 28% of your earnings and forward the proceeds to the IRS as a type of backup withholding. More commonly, the survey company will just stop sending you surveys, thereby halting any future earnings. The best thing to do is to fill out a W-9 when you’re asked to do so and complete it correctly using real and accurate information.

This entire process makes me angry!

If being asked to complete a W9 makes you angry, your anger may be misdirected…the reality is that when you are contacted by a survey company to complete a W9, the survey company is simply complying with USA tax law, as administered by the IRS. Failure to comply with these laws means that the market research company could end up in hot water!

When you are asked to complete a W-9, you are not being singled out or picked on. It’s actually a positive thing as it means you have earned $600 or more by taking online surveys! Taxes are unavoidable and everybody pays them. If you accept this, asking to complete a W-9 form won’t seem like such a terrible thing.

***Disclaimer: The information on this web page is not meant to substitute the advice from a professional. Please consult an accountant or other professional advisor to assist you in best using the information presented here. ***

Links:

Form W9: https://www.irs.gov/pub/irs-pdf/fw9.pdf

Instructions on completing form W9: https://www.irs.gov/pub/irs-pdf/iw9.pdf

Form W8-BEN (for non-USA residents): https://www.irs.gov/pub/irs-pdf/fw8ben.pdf

If I do not own a business and am only filling out a W9 form for taking surveys do I check anything off in box 3 or leave it blank

Hi Merri,

This video, provided by the IRS, should help answer your question: https://www.irsvideos.gov/Individual/Resources/HowToCompleteFormW-9

Will the irs hunt me down if I don’t fill out w9 form?

Hi Lulu,

If you don’t fill out a W9 form, among other things, the market research company whose survey panel you are a member of can start deducting a significant portion of your survey earnings in order to comply with US tax law. Alternatively you may be fined, or you even risk not receiving future surveys from the survey site.

Best to be honest and fill out these forms. Tax evasion is a serious crime and if you’re in a low income bracket, claiming any extra money you’ve made from surveys might not mean you’ll have to additional taxes anyway.